Mortgage simulator

Get an initial estimate of your home mortgage, borrowing capacity, monthly payment and fees in no time.

How do you calculate borrowing capacity?

This mortgage simulator is a guide only, and gives you an estimate of how much you could borrow and what would be the costs related to the mortgage, based on the income and expenses you entered. In order to provide you with an estimation of your borrowing capacity we consider a debt to income ratio of 40% to 45%.

In addition to the property price you would need to pay the acquisition costs which we have added in our simulator. These normally include the registration fee, the bank fee, the mortgage fee and the notary fee. In case of a real estate purchase in the Luxembourg for your main residence, you can benefit from a tax credit of up to 40,000 euros per head on the registration fee. In the case of a off-plan investment intended for rental, this amount is 20,000 euros per purchaser.

Generally the down payment required when you are buying for the fist time should cover the acquisition fees plus 0 to 10% of the property value depending on the bank. When you are buying for the second time your down payment should cover the acquisition fees and 10% of the property value. Finally, if you are buying as an investor your down payment should cover at least the acquisition fees and 20% of the property value.

The tax savings are calculated based on a maximum deductible amount per year per person equal to 4,000 euros for the first 5 years, 3,000 for the following 5 years and 2,000 for the rest of the duration of the loan. If you would like to get advice on the tax savings you can obtain contact taxx.lu

Last, since interest rates change constantly depending on the local and worldwide economic conditions, the one used in our simulator is indicative and varies according to the duration of the loan. Reach out to one of our experts at any time to get to know what interest rate would apply to your specific case.

We want to help you find your new home

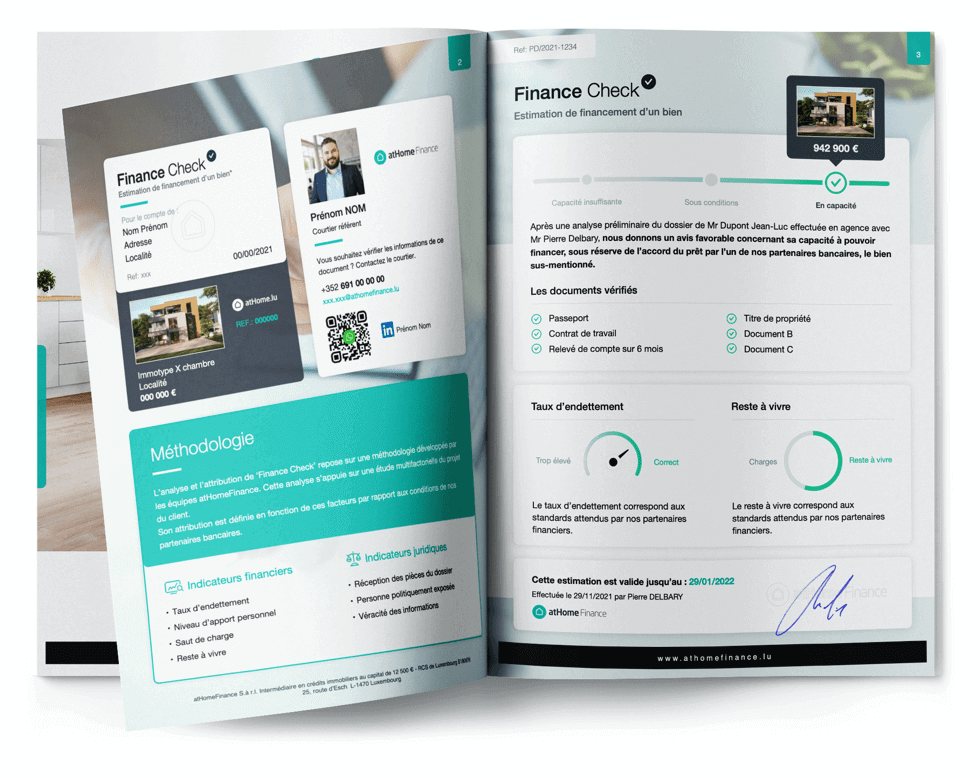

Get priority in visits by showing your Finance Check!

The Finance Check is the ultimate asset for a successful real estate purchase.

With the Finance Check, sellers will know that you really have the financial capacity to buy their property. They will choose you among the dozens of solicitations they receive every day and you will have every chance of completing your purchase.

The Finance Check is free and without obligation.

All it takes is a short face to face or virtual meeting with one of our atHomeFinance brokers.

Latest news and guides

Everything you need to know about mortgage, explained by our experts.