What is the profile of loan applicants in 2019?

They are aged between 30 and 39, are married and have borrowed an average of 550,000 euros to finance a property. This is the portrait of the loan applicant in Luxembourg in 2019.

atHomeFinanceLuxembourg mortgage broker, presents the typical borrower in the Grand Duchy in 2019.

While property prices in Luxembourg soared last year (with increases of between 12 and 14%), very low lending rates encouraged buyers to realise their property projects. But who are these buyers who have invested in property in Luxembourg?

Answer from the mortgage expert atHomeFinance!

Methodology: Averages calculated on the basis of loan applications received by atHomeFinance between 1 January and 31 December.er January 2019 and 31 December 2019.

Couples in their thirties

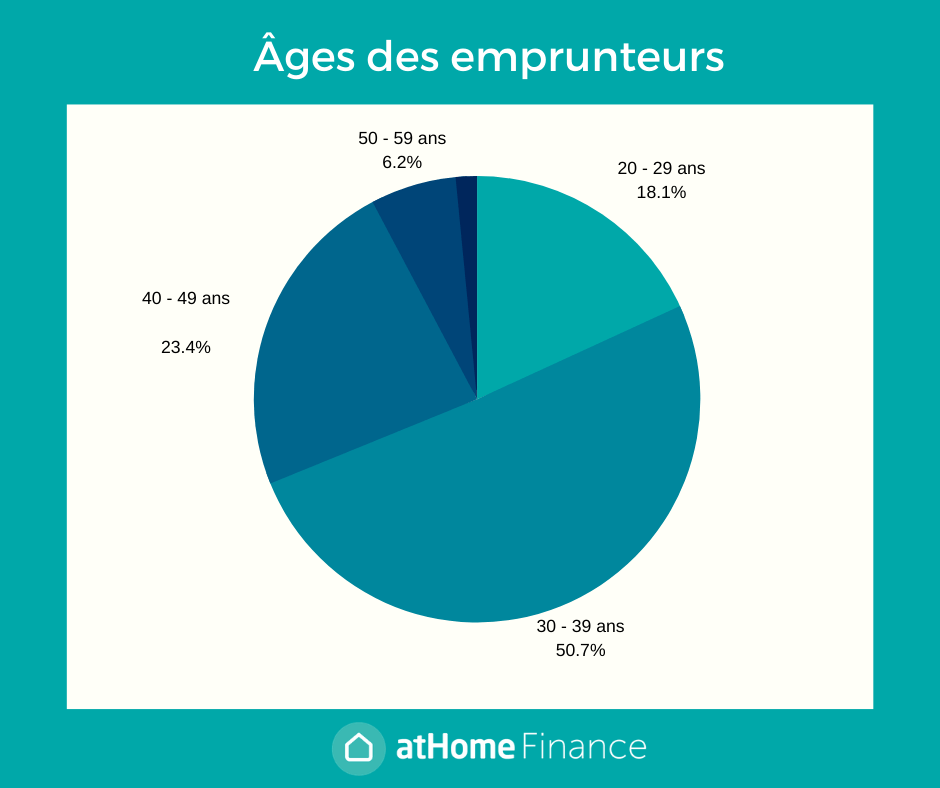

With house prices in Luxembourg at record levels, most people buying in the country are already in their thirties. In 2019, half of all home loan applications were made by women. borrowers aged between 30 and 39 (51%). The 40-49 age group accounts for 23% of loan applicants, while only 18% of 20-29 year olds have borrowed in the past year, often not yet having made a real contribution.

Most of the prospective buyers are married, civil union or common-law couples (72%). In other words, they most often buy and borrow in pairs. Single people account for 28 % of loan applications.

In terms of nationalities, the top 3 are divided between :

Luxembourgish = 19.7 %

Portuguese = 11.4 %

Italians = 5.1 %

A total of 81 different nationalities applied for loans in 2019.

Note that the vast majority (85%) of the profiles are Luxembourg residents.

Finally, the average household income of loan applicants is €6,500 per month (all statuses combined).

What are the property prices at the moment?

A primary residence, an old house

The main reason buyers take out a home loan is to to finance their main residence, for 94% of them. An investment that is still popular in a rising property market.

The type of property remains mainly a old housing (64%) with or without work. New construction and off-plan purchases account for 28% of borrowing.

The The average loan application amounted to EUR 550 000615,000 for projects with an average value of The average price of a flat in Luxembourg was 530,000 euros for a flat in October 2019, and 860,000 euros for a house.

In the majority of cases, the amount of the loan application is therefore between €400,000 and €599,999, for 29.9 % of borrowers. The sum is between €200,000 and €399,999 for 26.1 % of applicants and 22.4% plan to borrow between €600,000 and €799,999.

The average contribution is 70,000 euros, or approximately 10 % of the total project amount.

Written by

atHome

Posted on

06 March 2020