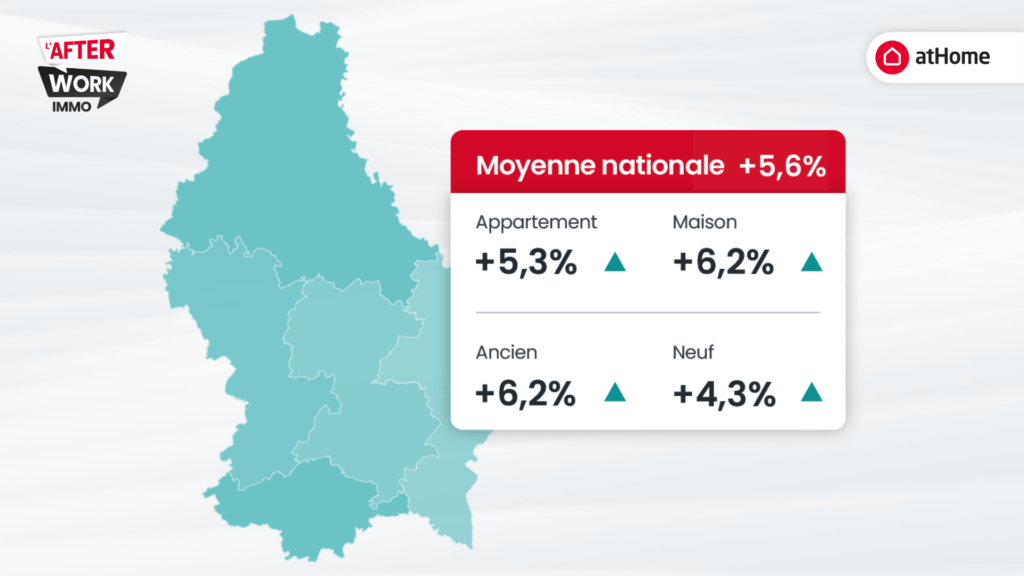

Real estate: +5.6% growth in 2022

+5.6% growth on announced prices in 2022: the slowdown is confirmed

The economic situation (rising interest ratesIn 2022, a sharp slowdown in real estate prices is caused by high inflation. Growth is divided by 2 compared to the previous year.

Here are the overall price increases forecast for 2022, by type of property:

- +5.3% for flats

- +6.2% for houses

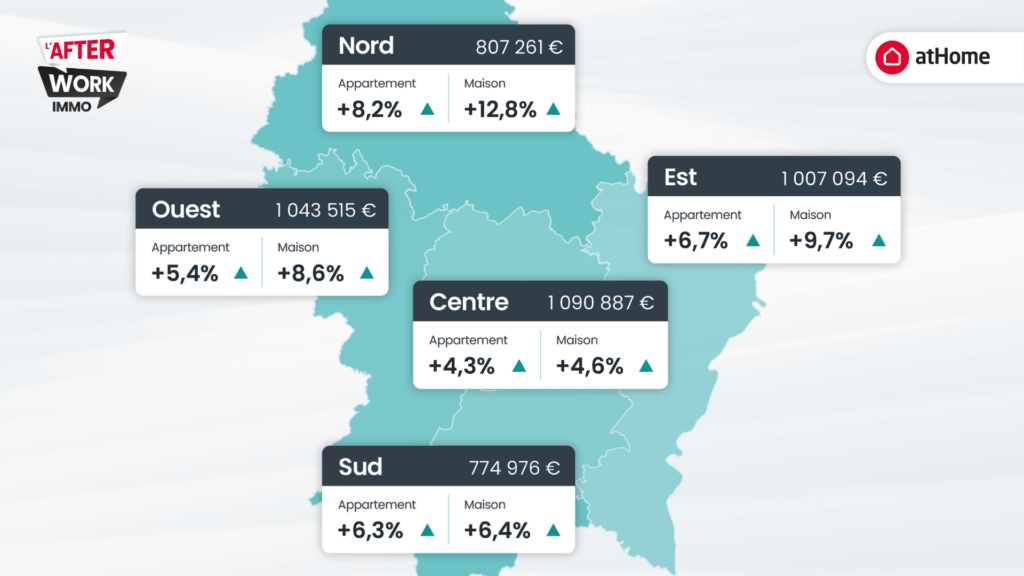

And here is the price evolution for each region in 2022, compared to 2021:

- Centre : +4.3% for flats and +4.6% for houses

- North : +8.2% for flats and +12.8% for houses

- South : +6.3% for flats and +6.4% for houses

- East : +6.7% for flats and +9.7% for houses

- West : +5.4% for flats and +8.6% for houses

This trend is based on the prices observed on atHome.lu for all the new listings of the last quarter. It is to be confirmed with the next figures of the Observatoire de l'Habitat concerning the sale prices, after negotiation and signature at the notary.

Flats: the evolution of advertised prices, quarter by quarter

Here is the evolution of the price of the ads for flatscompared to the same period in 2021:

- 1st quarter : +10,9%

- 2nd quarter : +6,9%

- 3rd quarter : +3,6%

- 4th quarter : +1,1%

Houses: the evolution of advertised prices, quarter by quarter

This is the dynamics of the prices advertised on atHome.lu for the houses in 2022 :

- 1st quarter : +10,2%

- 2nd quarter : +9,3%

- 3rd quarter : +4,9%

- 4th quarter : +1,0%

What is the difference between the advertisement prices and the final sales prices?

The prices in the advertisements are generally higher than the final selling prices. This is because purchase prices are often negotiated at the time of the compromise sale, especially in this period when buyers are scarce.

If you are planning to buy a property in Luxembourg: 2023 is a good year to invest. You will be able to negotiate your price more easily and make a good deal.

Will prices fall in Luxembourg? Should you buy or rent in 2023?

After years of double-digit growth, the evolution of posted prices is now undergoing a clear slowdown. So: is this trend sustainable? Or is it temporary?

Check out the replay of our webinar to find out what the experts atHome and the Observatoire de l'Habitat think about the future of price evolution.

Towards a new rise in interest rates?

Three consecutive increases in key ECB interest rates

The year 2022 has been an eventful one for home loan interest rates. The successive increases in key rates by the European Central Bank have caused a surge in fixed rates.

These successive increases have an impact on rates:

- In January 2022The 30-year fixed rate was 1,4%

- In October 2022The rates offered by atHomeFinance's partner banks were around 3.5%after a peak of 3.8% in June

- By the end of the year, These exceeded 4% in 30-year fixed rate.

"We expected rates to stabilise at the end of the year. But the ECB's key rate hike has reshuffled the deck."

Yann Gadéa, atHomeFinance

These rate increases have reduces the borrowing capacity of buyers by an average of 23% in Luxembourg. This has led to a sharp slowdown in the growth of property prices.

Variable rates: room for manoeuvre still available for your loan

Fortunately, there are solutions to limit the impact of the rate increase on its budget:

- By comparing several bank offers with a real estate loan broker to find the best rate among a wide selection of banks

- By opting for a combination of fixed and variable rate according to their life plans in Luxembourg, and thus benefit from lower overall rates on their loan

You can also consult interest rates in Luxembourg at the moment. We update this article regularly.

Methodology of our studies

Our studies aim to establish trends in the Luxembourg property market on a quarterly basis.

They aim to help buyers, sellers and estate agents make the best decisions in a constantly changing market.

To do this, we analyse the evolution of the following indicators each quarter:

- Advertised property prices. We analyse the prices of new listings published on atHome.lu, Luxembourg's leading property portal. The analysis of these advertised prices makes it possible to establish averages (by region, type of property) each quarter, and to compare their evolution with the same quarter of the previous year.

- The evolution of interest rates. We analyse the average interest rates of the banking partners of atHomeFinance (the number one home loan brokerage service in Luxembourg). These partners are numerous and allow us to have a good average view of the market, even if all the banks are not represented and the conditions for granting loans depend on each establishment. Once this average is obtained, we compare the evolution of fixed and variable interest rates each quarter with the previous quarter.

We also take care, as much as possible, to invite the players in the real estate market to participate in our various studies and analyses, as is the case on our YouTube channel.

Written by

atHome

Posted on

26 January 2023