Real estate: signs of recovery in Q1 2024?

At the start of 2024, here are the observations made by analysing the data from atHome.lu :

- Advertised sale prices continue to adjust, encouraging a resumption of transactions on the market

- After rising sharply in 2023, rents are stabilising, symbolising the end of the massive shift of buyers to the rental market

- Interest rates are falling significantly, for the first time since the start of the crisis in 2022. Rates of less than 3.5% have been recorded by atHome Finance.

Advertised selling prices: the adjustment continues

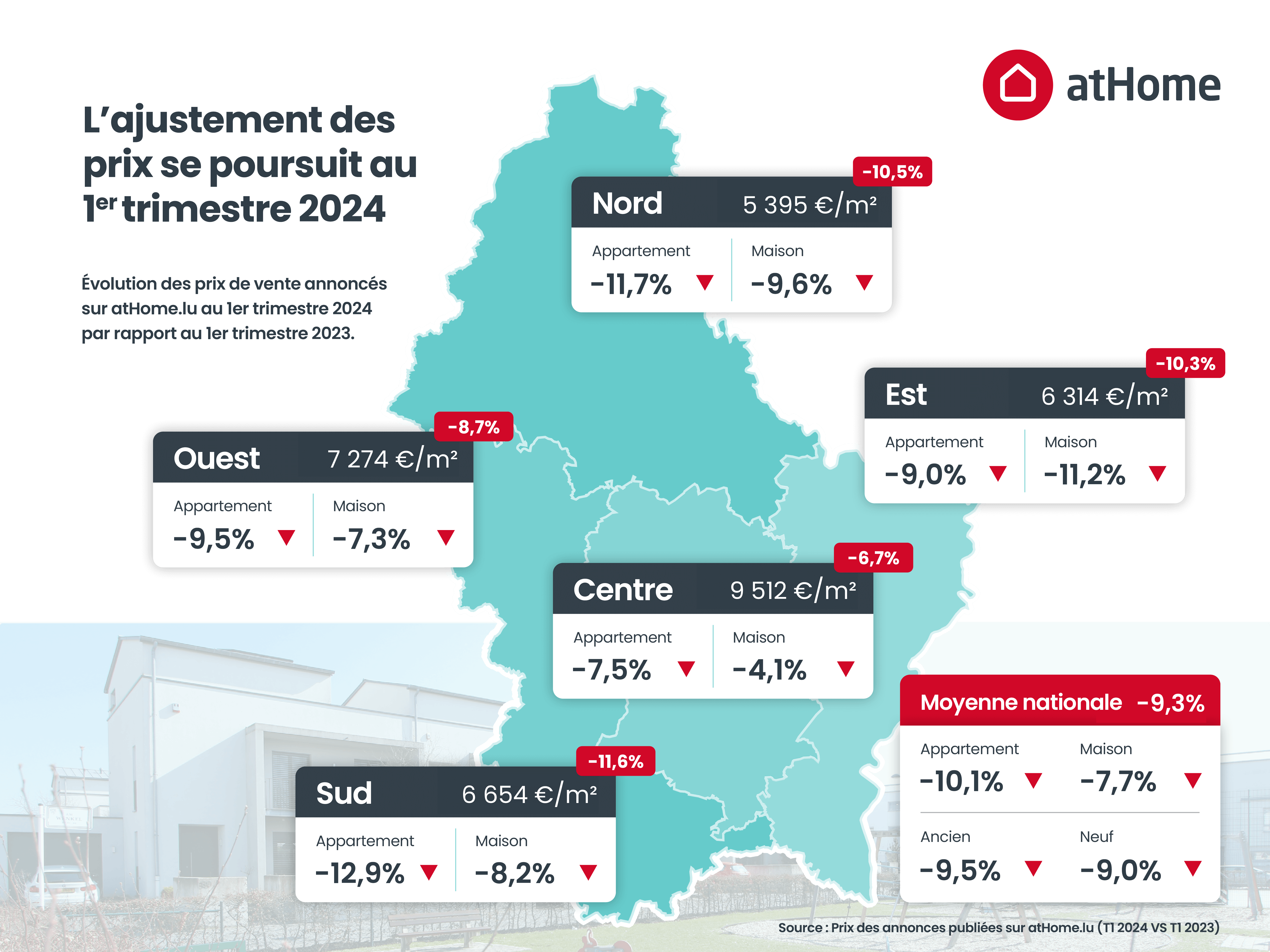

The property market in the first quarter of 2024 shows a marked readjustment in prices compared with the first quarter of 2023. This trend extends to all regions of Luxembourg. Statistics show an overall fall in prices of around -9.3%The decline was more pronounced for flats (-10.1%) than for houses (-7.7%).

Prices for existing and new properties are evolving in the same proportions.

Here are the details of prices per square metre and their evolution by region in the first quarter of 2024, compared to the first quarter of 2023:

- Centre: €9,512/m², with an average decrease of -6.7%. Flats saw an adjustment of -7.5%, while houses saw a moderate fall of -4.1%.

- North: €5,395/m². The average fall was -10.5%There was a more marked fall for flats (-11.7%) and a reduction for houses (-9.6%).

- South: €6,654/m². Prices down 11.61TP3Q. Flats fell by -12.9%, while houses recorded a contraction of -8.2%.

- East: €6,314/m², with an adjustment of -10.3%. Flats fell by -9.0% and houses by -11.2%.

- West: €7,274/m², showing an adjustment of -8.7% on average, with -9.5% for flats and -7.3% for houses.

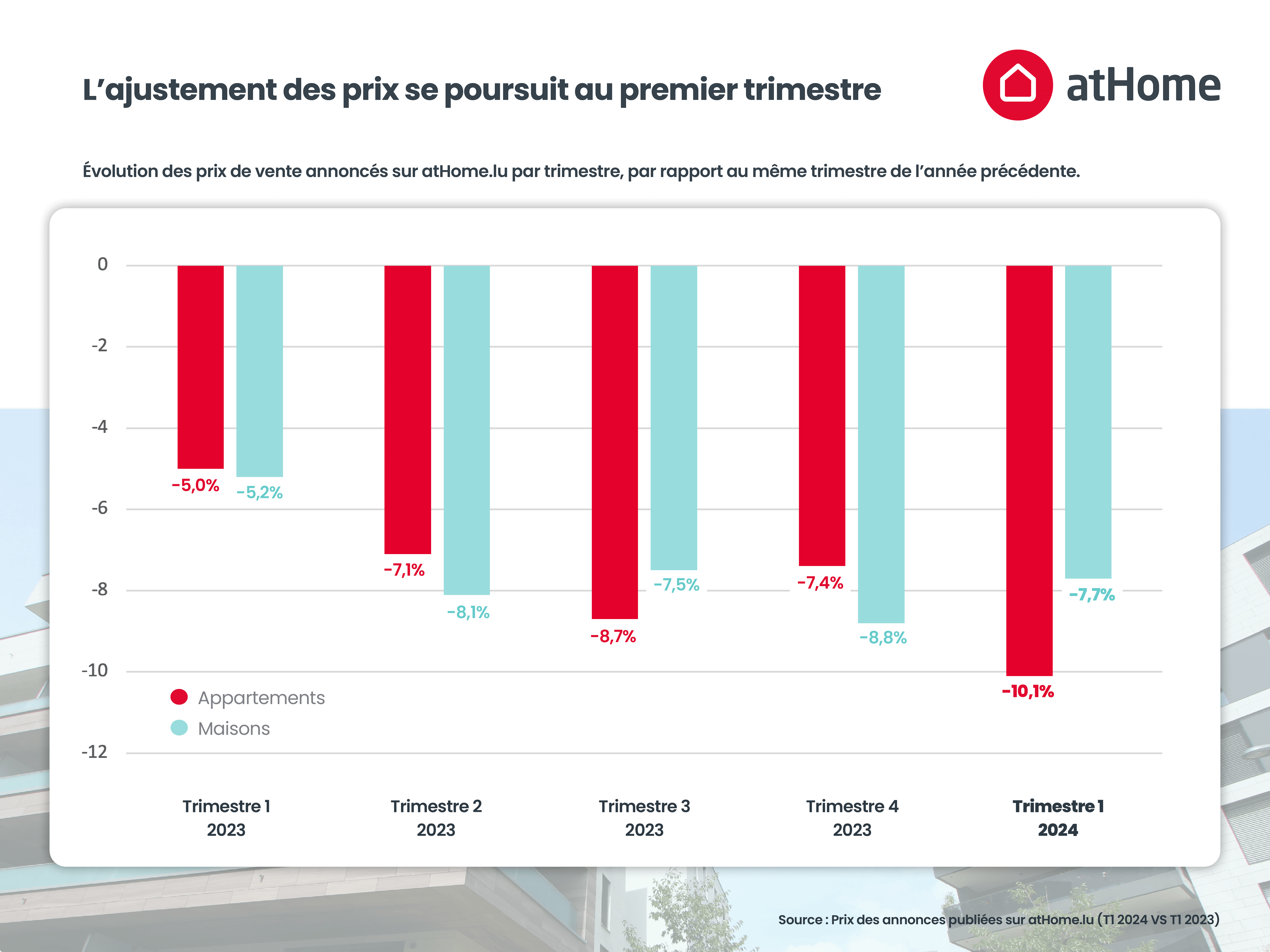

If we now analyse price trends by quarter, we can see that the fall in prices accelerates as 2023 progresses, finally levelling off at the end of 2023 and the beginning of 2024. This adjustment in prices is associated with an upturn in activity on the property market. With adjusted prices, transactions are picking up again.

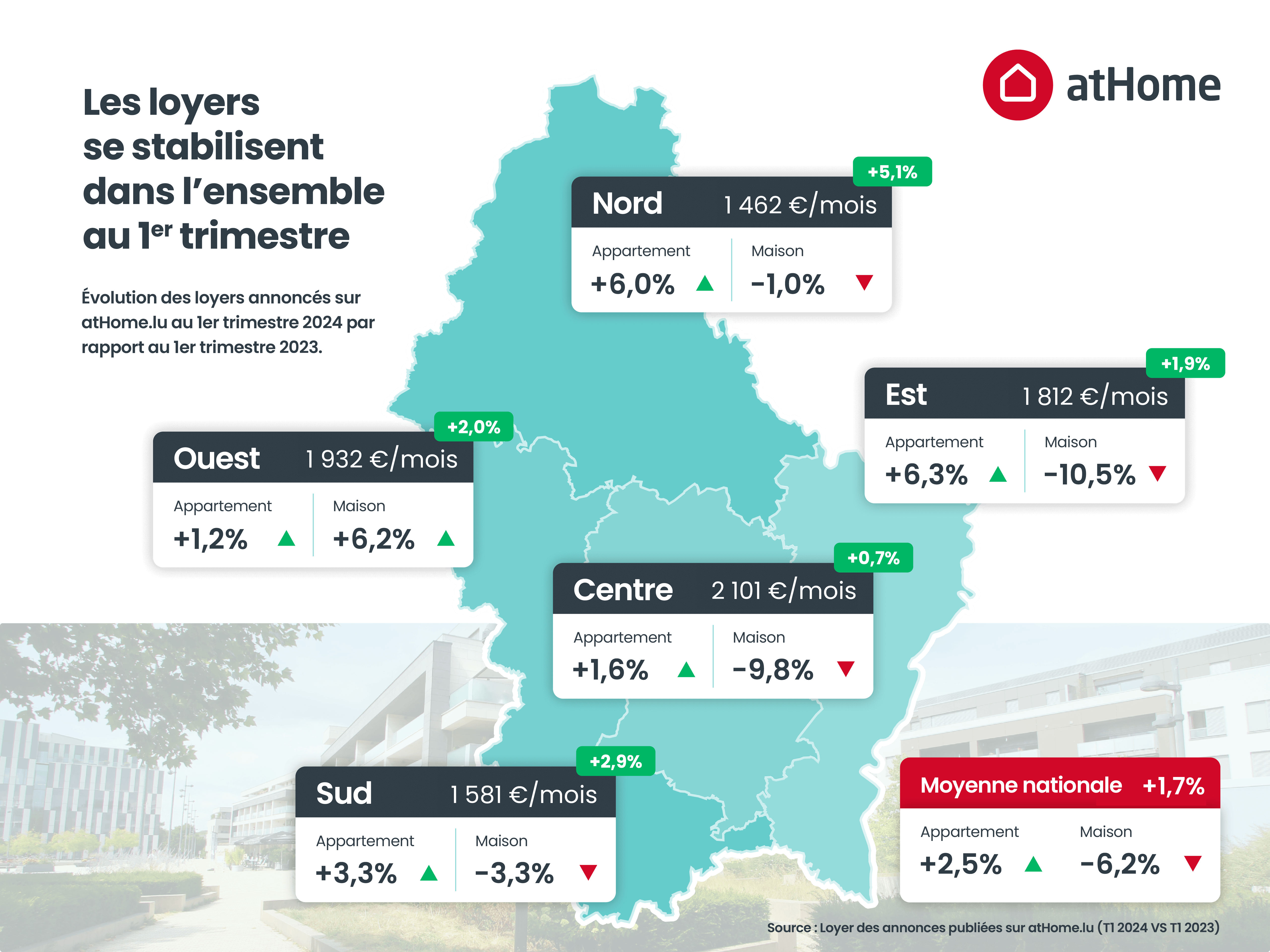

Rents: +1.7% on average, but many disparities

The rental market is tending to stabilise. The rise in rents as a whole slowed significantly in the first quarter of 2024 (with the national average increasing by only +1.71TP3Q).

It symbolises the end of the massive shift from buyers to renters. This time, buyers seem to be returning to the market, and gradually turning away from renting.

But this moderation is reflected differently depending on the type of property: flats recorded an increase of +2.5%, while houses saw a fall in rents of -6.2%.

In some regions, these differences are even more marked, with a sustained rise in rents for flats and a fairly significant fall in rents for houses.

Here are details of average rents and their annual change by region:

- Centre: €2,101, with a slight increase of +0.7%. Flats rose by +1.6%, while houses fell sharply by -9.8%.

- North: €1,462, with rents rising by an average of +5.1%. Flats gained +6.0%, while houses saw a slight decrease of -1.0%.

- South: €1,581, up 2.9%. Flat rents rose by +3.3%, while house rents fell by -3.3%.

- East: €1,812, with a moderate increase of +1.9%. Flats saw a notable increase of +6.3%, in contrast with a sharp fall for houses to -10.5%.

- West: €1,932, showing a slight increase of +2.0%. Flats saw a modest increase of +1.2%, but houses rebounded with a significant rise of +6.2%.

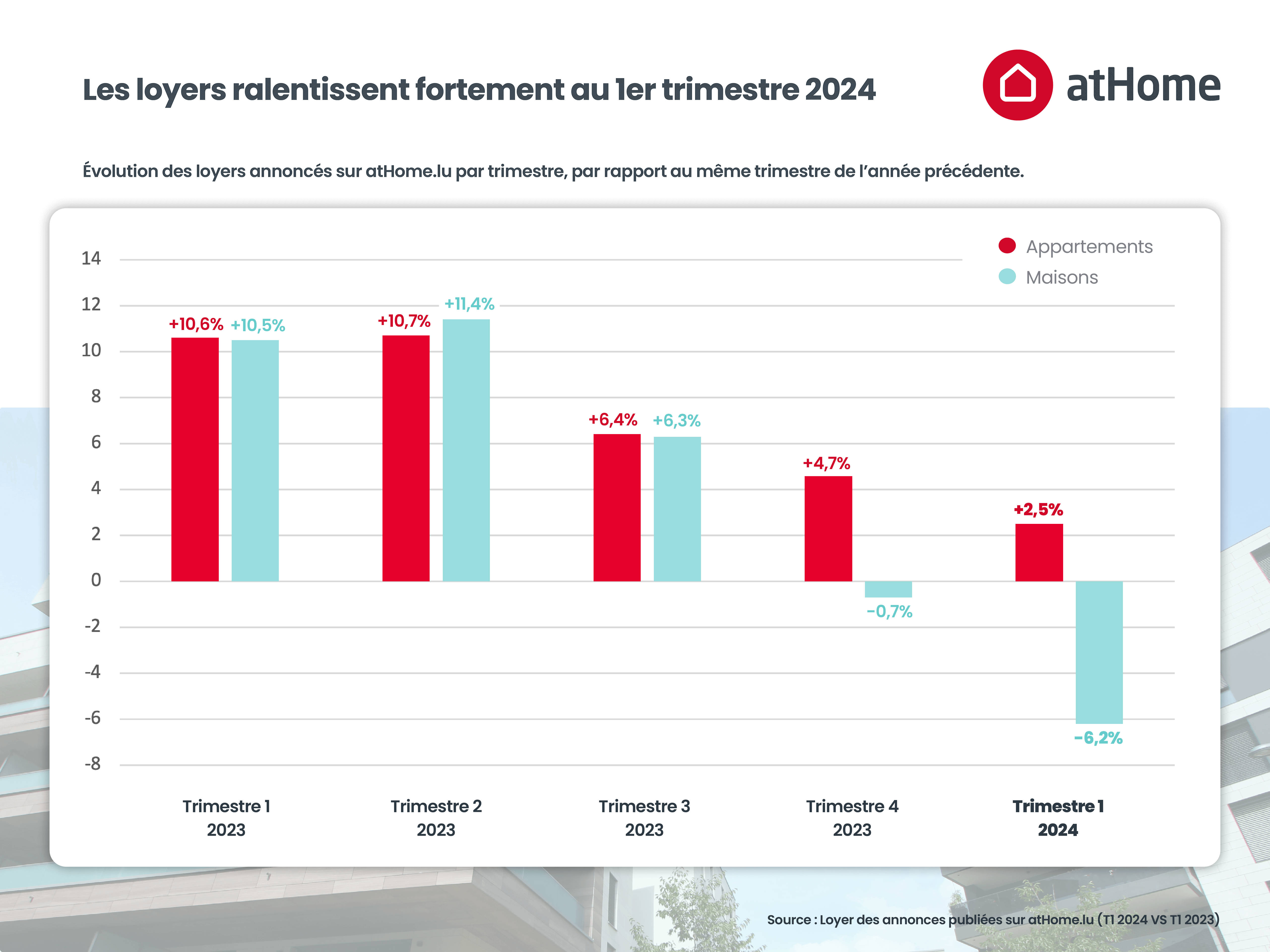

An analysis of trends by quarter shows a gradual slowdown in rents from mid-2023, following double-digit growth. In the 1st quarter of 2024, rents for flats in Luxembourg still increased by +2.5%, but houses fell by -6.2%.

Rates fall significantly in Luxembourg

This is very good news for the property market at the start of the year. Rates had tripled by 2022. After a long period during which they fluctuated between 4.5% and 5%, they are now recording the most significant fall in the property market since the start of the crisis.

The rates offered by atHome Finance now vary between 3.5% and 3.8% depending on your profile and the bank's offer. Some banks even make very aggressive promotional offers, going as low as below 3.5% on certain files.

Luxembourg's central banks and banking institutions are forecasting a number of rate cuts over the coming months, which should speed up the property market's recovery by 2024-2025.

Note that the energy passport of a property is increasingly taken into account in the way banks set interest rates:

- High energy passports (A, B) generally achieve a base rate compared to other properties on the market

- Some banks even offer to reduce their interest rate if buyers undertake to carry out energy-efficiency renovation work that will change the property's energy rating.

What is the outlook for the property market in 2024?

Many Luxembourg professionals agree that 2024 will be a year of transition, before a real upturn in 2025.. There are several reasons for this:

- 2024 sees the first rate cuts, expected during the 2e or 3e quarter

- Macro-economic indicators show a slight recovery in GDP, but a depressed employment market (with the unemployment rate reaching 6% according to STATEC forecasts)

- The tax incentives proposed by the Government are encouraging an early recovery in the market

To find out more, watch the replay of our special webinar: " What is the outlook for Luxembourg real estate in 2024? "

Written by

atHome

Posted on

02 April 2024